Don't skimp on your lifestyle – now or later. Our top interest rate on your 3a retirement account means your savings will give you more when you retire. And that is on top of attractive tax benefits, no account management fee and full transparency via CIC eLounge. So you can relax now while saving for your future – with the satisfying feeling that you are enjoying one of the best interest rates in Switzerland.

For over ten years, the Bank CIC preferential rate has been one of the best interest rates in the country. The Bank CIC retirement funds universe consists of funds from different suppliers carefully selected by the Bank to meet a range of quality criteria. We particularly look at value for money, sustainability and diversity in our range, and attempt to offer clients the best possible selection of funds.

Ongoing monitoring ensures the offering meets the criteria that have been set. There are various investment focuses: equity weighting, the strategy focus or a thematic approach. Choose from a large selection of attractive retirement funds from various provider.

Do you want to provide for your future, still have enough money later in life to make your dreams come true and save taxes at the same time? Then the 3a retirement solution is just right for you. Investing your money in funds also allows you to benefit from opportunities for higher returns. Generally, the longer you can leave your money invested, the better. Pick your retirement fund from four different investment strategies with varying equity weightings, and take a big step towards achieving your retirement saving goals.

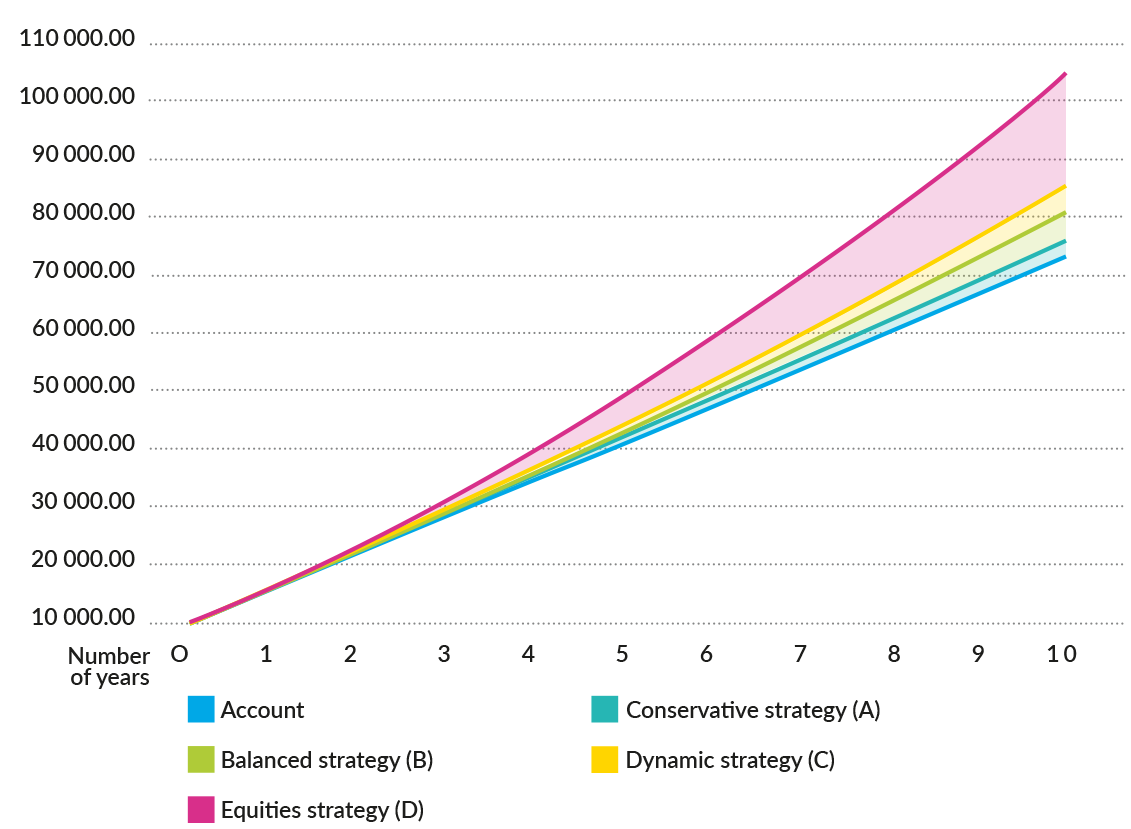

Starting balance: CHF 10 000

Frequency of contributions CHF 6 000 per year

Calculation basis Historic interest rates and returns over the last 10 years

Retirement capital on maturity with account solution: CHF 72 881

Retirement capital on maturity with equity strategy: CHF 104 665

Difference CHF 31 784

Basis for sample calculations and references

The comparison is based on past performance and is not an indicator of future performance before fees and taxes. Reference date: 1 November 2022. Basis: Retirement fund in pillar 3a investment savings plans of Bank CIC, equities return based on the benchmark calculation. Sources: Bloomberg, VZ Vermögenszentrum

Here you will find a complete selection of retirement funds sorted by provider.

| Investment product | Securities no. | % equities | Investment strategy |

|---|---|---|---|

| BVG - Mix 15 | 1564965 | 15% | Conservative |

| BVG - Mix 25 | 1245601 | 25% | Balanced |

| BVG - Mix 35 | 1245606 | 35% | Balanced |

| BVG - Mix 45 | 1245607 | 45% | Dynamic |

| BVG - Mix 75 | 43583002 | 75% | Equities |

| BVG - Mix Index 15 | 137660518 | 15% | Conservative |

| BVG - Mix Index 25 | 137660520 | 25% | Balanced |

| BVG - Mix Index 35 | 137660522 | 35% | Balanced |

| BVG - Mix Index 45 | 137661035 | 45% | Dynamic |

| BVG - Mix Index 75 | 137661037 | 75% | Equities |

|

Investment product |

Securities no. |

% equities |

Investment strategy |

|---|---|---|---|

| BVG 3 Portfolio 15 RT | 23805195 | 15% | Conservative |

| BVG 3 Portfolio 25 RT | 23805270 | 26% | Balanced |

| BVG 3 Portfolio 45 RT | 23805297 | 45% | Dynamic |

| BVG 3 Sustainable Portfolio 45 RT | 23804772 | 45% | Dynamic |

| BVG 3 Index 45 RT | 23804645 | 45% | Dynamic |

| BVG 3 Responsible Portfolio Protection RT | 23804622 | 0-50% | Dynamic |

| Swisscanto (CH) Vorsorge Fonds 75 Passiv | 35369090 | 75% | Equities |

| Swisscanto (CH) Vorsorge Fonds 95 Passiv | 51196142 | 95% | Equities |

|

Investment product |

Securities no. |

% equities |

Investment strategy |

|---|---|---|---|

| BVG-25 Aktiv Plus I-A1 | 11763766 | 25% | Balanced |

| BVG-25 Indexiert (hedged in CHF) I-A1 | 11764415 | 25% | Balanced |

| BVG-40 Aktiv Plus I-A1 | 11763867 | 40% | Dynamic |

| BVG-40 Indexiert (hedged in CHF) I-A1 | 27400346 | 40% | Dynamic |

| UBS Vitainvest Passive 25 Sustainable | 111013412 | 25% | Balanced |

| UBS Vitainvest Passive 50 Sustainable | 111013413 | 50% | Dynamic |

| UBS Vitainvest Passive 75 Sustainable | 111013414 | 75% | Equities |

| UBS Vitainvest Passive 100 Sustainable | 111013415 | 95% | Equities |

The 3a retirement solution from CIC ON makes it easy for you to provide for the future and enjoy attractive tax benefits at the same time. Decide for yourself how much you want to pay in to your 3a retirement solution and when. This might be whenever you feel like it, or regularly with a standing order – whatever suits your budget. Because this solution is meant for your pension provision, the money is tied up. But if you want to buy a house or a flat or go freelance, you can withdraw your assets at any time.

Take advantage of tax benefits

With every payment into your 3a retirement account, you will be taking advantage of multiple benefits. The amount you pay into your 3a retirement account each year can be deducted from your taxable income. Depending on where you live, you start saving between CHF 200 and CHF 400 in tax when you contribute as little as CHF 1,000. You also enjoy these tax benefits when you invest the money in retirement funds.

It's worth spreading your 3a retirement assets across several accounts because it also has a positive impact on the tax savings if you make withdrawals in stages from your 59th birthday onwards. A reduced tax rate applies when withdrawing retirement savings.

Enjoy opportunities for higher returns

If you want to invest your retirement savings, or some of them, in a 3a retirement fund, you can also enjoy opportunities for higher returns. You decide how much of your capital you want to invest. There is no need to worry about selecting individual stocks. Get started with an initial investment of as little as CHF 1,000 and flexible follow-up investments from CHF 500 and set off directly into a rosy future. Buying fund units in stages means you benefit over the long term from low average prices. This lets you get more out of the capital you have paid in, so you can provide for your retirement efficiently.