If you invest some or all of your retirement savings in a retirement fund, you can benefit from opportunities for higher returns. You decide how much of your capital you want to invest. There is no need to worry about selecting individual stocks.

Get started with an initial investment of as little as CHF 1,000 and flexible follow-up investments from CHF 500, putting you on the right track for a bright future. Buying fund units in stages means you benefit over the long term from low average prices. This lets you get more out of the capital you have paid in, so you can provide for your retirement efficiently.

If you have a medium to long-term time horizon, it is worth investing some or all of this capital in retirement funds.

Buying fund units in stages

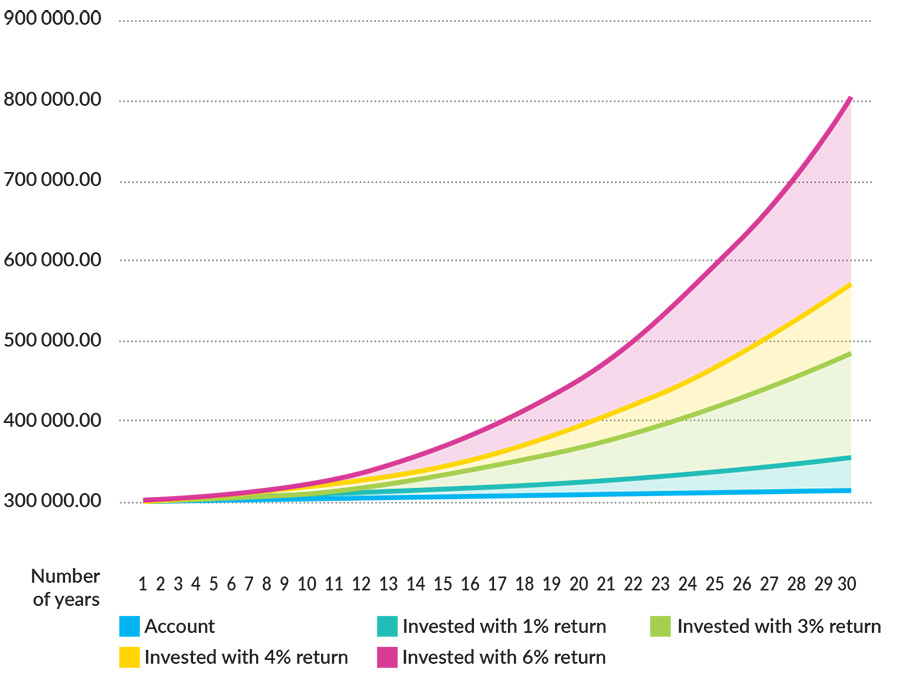

Vested benefits capital CHF 300,000

Initial investment: CHF 10,000

Follow-up investments: CHF 10,000 per year

Vested benefits capital on maturity with account solution: CHF 313,000

Vested benefits capital on maturity with equity strategy: CHF 800,000

Difference CHF 487,000

Basis for sample calculations and references:

- Vested benefits account: current Bank CIC interest rate 0.15% p.a.

- Retirement fund in the Conservative investment strategy: expected annual return 1%

- Retirement fund in the Balanced investment strategy: expected annual return 3%

- Retirement fund in the Dynamic investment strategy: expected annual return 4%

- Retirement fund in the Equities investment strategy: expected annual return 6%

Expected returns are based on the past performance of the different investment strategies. Past performance is not a reliable indicator of future results. These assumptions are based on gross figures before fees and taxes.

Here you will find a complete selection of retirement funds sorted by provider.

|

Investment product |

Securities no. |

% equities |

Investment strategy |

|---|---|---|---|

| BVG-Mix 15 Plus R | 12424959 | 15% | Conservative |

| BVG-Mix 25 Plus R | 12424966 | 25% | Balanced |

| BVG-Mix Dyn. Allocation 0-40 | 34387912 | 0-40% | Balanced |

| BVG-Mix Dyn. Allocation 0-80 | 43200504 | 0-80% | Dynamic |

| BVG-Mix 40 Plus R | 12424973 | 40% | Dynamic |

|

Investment product |

Securities no. |

% equities |

Investment strategy |

|---|---|---|---|

| Mixta-BVG Basic I | 1503660 | 0% | Conservative |

| Mixta-BVG I | 2733319 | 35% | Balanced |

| Mixta-BVG Index 45 I | 11269573 | 45% | Dynamic |

| Mixta-BVG Index 75 | 38261472 | 75% | Equities |

|

Investment product |

Securities no. |

% equities |

Investment strategy |

|---|---|---|---|

| BVG-Ertrag A | 2455689 | 15% | Conservative |

| BVG-Rendite A | 1016859 | 25% | Balanced |

| BVG-Nachhaltigkeit Rendite A | 3543791 | 25% | Balanced |

| BVG-Wachstum A | 287401 | 35% | Balanced |

| BVG-Nachhaltigkeit A | 1016862 | 38% | Balanced |

| BVG-Zukunft A | 2455731 | 45% | Dynamic |

| BVG-Aktien 80 A | 44120031 | 80% | Equities |

|

Investment product |

Securities no. |

% equities |

Investment strategy |

|---|---|---|---|

| BVG 3 Portfolio 10 RT | 23805195 | 10% | Conservative |

| BVG 3 Portfolio 25 RT | 23805270 | 26% | Balanced |

| BVG 3 Portfolio 45 RT | 23805297 | 45% | Dynamic |

| BVG 3 Sustainable Portfolio 45 RT | 23804772 | 45% | Dynamic |

| BVG 3 Index 45 RT | 23804645 | 45% | Dynamic |

| BVG 3 Dynamic 0-50 RT | 23804622 | 0-50% | Dynamic |

| Swisscanto (CH) Vorsorge Fonds 75 Passiv – VT | 35369090 | 75% | Equities |

| Swisscanto (CH) Vorsorge Fonds 95 Passiv – VT | 51196142 | 95% | Equities |

| Investment product | Securities no. | % equities | Investment strategy |

|---|---|---|---|

| BVG - Mix 15 | 1564965 | 15% | Conservative |

| BVG - Mix 25 | 1245601 | 25% | Balanced |

| BVG - Mix 35 | 1245606 | 35% | Balanced |

| BVG - Mix 45 | 1245607 | 45% | Dynamic |

| BVG - Mix 75 | 43583002 | 75% | Equities |

|

Investment product |

Securities no. |

% equities |

Investment strategy |

|---|---|---|---|

| BVG-25 Aktiv Plus I-A1 | 11763766 | 25% | Balanced |

| BVG-25 Indexiert (hedged in CHF) I-A1 | 11764415 | 25% | Balanced |

| BVG-40 Aktiv Plus I-A1 | 11763867 | 40% | Dynamic |

| BVG-40 Indexiert (hedged in CHF) I-A1 | 27400346 | 40% | Dynamic |

| UBS Vitainvest Passive 75 Sustainable Q | 111013414 | 75% | Equities |

| UBS Vitainvest Passive 100 Sustainable Q | 111013415 | 95% | Equities |

Would you like to open an account and buy funds directly in eLounge as soon as your retirement savings have been paid in? The pension agreement and the transfer form make it really easy for you to arrange for your existing vested benefits capital to be transferred from your previous pension institution to Bank CIC.

All terms and conditions for the retirement solution can be found here.

WITHDRAWAL AND EARLY PENSION RELEASE

The law permits you to withdraw your vested benefits as follows: